The big jobs report (officially called “nonfarm payrolls”) came in much weaker than expected. The headline showed 73,000 new jobs versus a forecast of 110,000. The real story was in the revisions. Payroll counts are always revised as more companies report to the Bureau of Labor Statistics (BLS). This happens for 2 months after the initial release. These 2 months of revisions were uncharacteristically big, accounting for a combined 253,000 reduction in the job count thus significantly downgrading the recent picture of the labor market.

Why does this matter for mortgage rates? Because a slower labor market leads to more bond buying, which in turn pushes rates lower. It also makes the Fed more likely to cut rates. Mortgage rates aren't tied to the Fed rate, but they do move lower in anticipation if a rate cut is widely expected. You could say that mortgage rates don't correlate well with the Fed Funds Rate itself, but very well with Fed Funds Rate expectations.

Looking ahead, this jobs report puts much more weight on the next round of data. Inflation reports will be closely watched, but so will the next jobs report in early September—just two weeks before the next Fed meeting. Markets are now actively pricing in the possibility of a rate cut at that meeting. Whether or not it actually happens will depend entirely on how the incoming data stacks up.

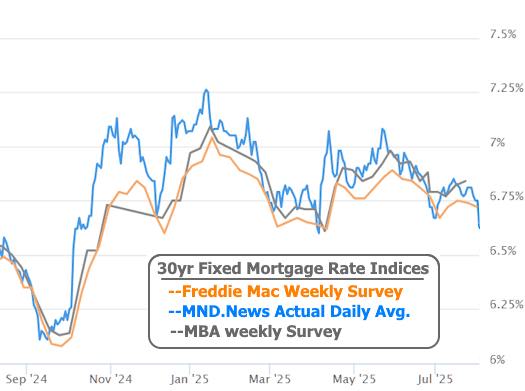

For now, the takeaway is simple: this was a good week for mortgage rates, and it came thanks to a labor market report that strongly suggested things are cooling off. If that trend continues, rates could move lower still. If not, the recent improvement could be short-lived.